Introduction

The banking and finance sector is undergoing a transformative shift, driven by the rapid adoption of Artificial Intelligence (AI) agents. These intelligent tools are revolutionizing operations, enhancing customer interactions, and streamlining risk management processes. As the industry grapples with the complexities of decentralized operational models, the integration of AI agents necessitates a robust enterprise framework. This article delves into the pivotal role of AI agents, the significance of a robust framework, and their application across various banking and financial domains.

The Role of AI Agents in Banking and Finance

AI agents are autonomous or semi-autonomous software programs designed to perform specific tasks efficiently. In the financial sector, they manifest as chatbots, robo-advisors, fraud detection systems, and virtual assistants, each bringing unique capabilities to the table:

- Chatbots: These agents handle routine customer inquiries, ensuring 24/7 availability while freeing human agents to address more complex issues.

- Robo-Advisors: Personalized investment advice, based on real-time data, helps customers make informed financial decisions.

- Fraud Detection Systems: These agents analyze transactional data to identify suspicious activities, significantly reducing fraud risks.

- Virtual Assistants: Offering tools for budgeting, financial planning, and transaction management, these agents elevate the customer experience.

Why a Robust Framework is Critical

A robust framework underpins the successful deployment and management of AI agents. Key components include:

- Data Privacy and Compliance: Ensuring adherence to regulatory standards with features like sensitivity labeling and access controls.

- Cost Efficiency and Scalability: Optimizing resources and enabling seamless scalability to meet growing demands.

- Performance Quality: Maintaining consistent behavior and reliability across diverse scenarios.

- Traceability and Visibility: Implementing mechanisms for real-time monitoring, issue diagnosis, and data lineage tracking.

- Adaptability: Modular architecture and pre-built components facilitate quick adaptation to changing business needs.

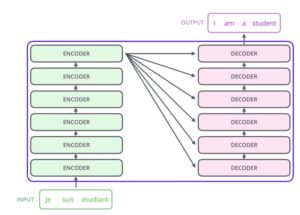

Designing an Effective AI Agent Architecture

Creating a robust AI agent system involves a meticulous approach to development and deployment:

- Role Assignment: Define clear roles for developers, security teams, AI councils, and business unit stakeholders.

- Model Selection and Customization: Choose AI models and integrate them with an orchestration layer, plugins, and action-specific APIs.

- Prompt Engineering: Develop structured prompts to ensure accurate agent responses, complemented by regular updates to align with evolving use cases.

- Scalability Planning: Account for quotas, context window truncation, and other limitations to optimize agent performance.

Security and Responsible AI Practices

Responsible AI deployment is paramount in the banking sector. Key considerations include:

- Integration with External Systems: Use secure function triggers and bindings for seamless connectivity.

- Authentication and Authorization: Rigorous testing of APIs to prevent unauthorized access.

- Ethical Guidelines: Implement policies to ensure transparency and fairness in AI-driven decisions.

Applications of AI Agents in Banking and Finance

AI agents are reshaping traditional processes across several critical areas:

- Customer Experience:

- Virtual assistants provide instant responses, personalized financial advice, and proactive alerts, enhancing satisfaction and loyalty.

- Risk Management:

- Machine learning algorithms analyze large datasets to detect anomalies, flag potential risks, and ensure compliance with regulatory requirements.

- Operational Efficiency:

- Automation of repetitive tasks like data entry and document processing reduces human workload and minimizes errors.

- Trading and Investment:

- High-frequency trading and sentiment analysis tools enable smarter investment strategies.

- Personalized Financial Planning:

- AI-driven insights help customers set realistic savings goals, manage spending, and optimize investments.

Preparing for the Future

The future of AI agents in banking is bright, with advancements in natural language processing, blockchain integration, and advanced machine learning unlocking new possibilities. These technologies promise:

- Enhanced Decision-Making: Real-time analytics and predictive modeling.

- Deeper Customer Insights: Granular understanding of customer needs and behavior.

- Seamless Integration: Interoperable systems enabling smoother workflows across departments.

Conclusion

Embracing AI agents is no longer a choice but a strategic imperative for financial institutions aiming to thrive in a competitive landscape. By adopting robust frameworks, leveraging advanced technologies, and prioritizing responsible AI practices, banks and financial institutions can unlock unprecedented efficiencies, bolster customer trust, and lead innovation in the digital age. The future of banking is here, and it is powered by intelligent AI agents.