In Banking, there is a huge amount of financial data. This data can be both challenging and useful. Big data analytics helps banks find valuable information hidden in all this data. By understanding customer behavior and managing risks, big data analytics changes how banks work and provide value to their customers.

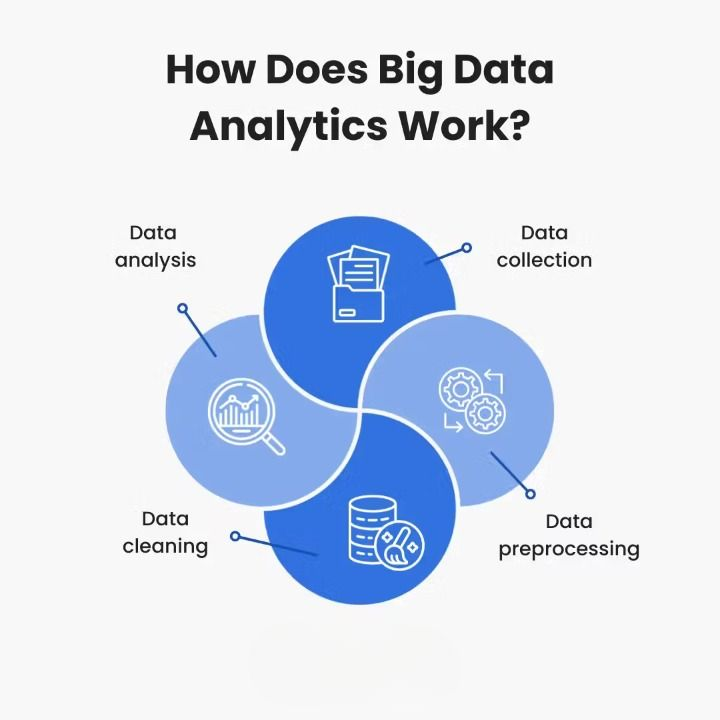

Data Collection

Banks gather extensive financial data from diverse sources. This includes:

Structured Data: Customer transaction records, loan details, credit card usage, and account balances.

Unstructured Data: Customer feedback from surveys, social media sentiments, and market news related to financial trends.

Example: A bank collects transaction data from ATM withdrawals, online banking activities, credit card transactions, and loan applications.

Data Storage

Banks store this wealth of financial data using robust systems designed for scalability and security. They utilize databases optimized for handling large volumes of data and ensure compliance with regulations.

Example: The bank employs a combination of on-premises and cloud-based databases to securely store customer transaction records and sensitive financial information.

Data Processing

Before analysis, banks preprocess the data to ensure accuracy and consistency. This involves:

- Cleansing data to remove errors and inconsistencies.

- Integrating data from disparate sources into a unified format.

- Enhancing data quality through normalization and validation processes.

Example: The bank standardizes transactional data formats, reconciles discrepancies in account balances, and verifies the accuracy of customer information.

Data Analysis

Banks employ sophisticated analytics techniques to derive insights from the vast amount of financial data they possess. This includes:

- Customer Segmentation: Identifying groups of customers with similar financial behavior.

- Risk Assessment: Evaluating credit risk, fraud detection, and market risk.

- Personalized Marketing: Tailoring product offerings and marketing campaigns based on customer preferences and behavior.

Example: The bank uses predictive analytics to assess creditworthiness, identifying potential default risks and fraudulent activities.

Data Visualization

Banks leverage data visualization tools to present complex financial information in a comprehensible format. This aids decision-makers in understanding trends, patterns, and outliers within the data.

Example: The bank creates interactive dashboards displaying real-time insights into customer spending patterns, loan performance, and market trends.

Decision Making

Armed with actionable insights, banks make data-driven decisions to optimize their operations, manage risks, and enhance customer experiences. These decisions may include:

- Introducing new financial products tailored to specific customer segments.

- Implementing targeted marketing strategies to increase customer engagement.

- Adjusting lending criteria based on risk assessments and market conditions.

Example: The bank adjusts interest rates on loans based on real-time market trends and customer credit profiles, optimizing its revenue while managing risk exposure.

Iterative Process

Big data analytics in banking is an iterative process characterized by continuous learning and refinement. Insights gleaned from previous analyses inform future data collection, model enhancement, and strategic decision-making.

Example: Based on the outcomes of marketing campaigns and customer responses, the bank refines its segmentation models and adjusts its product offerings accordingly.

Conclusion

Big data analytics empowers banks to extract actionable insights from their vast repositories of financial data, driving strategic decision-making, enhancing risk management, and delivering personalized customer experiences. This iterative process of data collection, analysis, and decision-making fosters continuous improvement and innovation within the banking sector.